This is the continuation to the previous Component TAA: Part 1

post.

First I will present the results with a single momentum strategy comparing the AA, TAA, and Momentum TAA strategies with 0 leverage and with 2-1 leverage. Then, I will present alternate momentum strategies using different js and ks, but investing in a constant number of ETFs followed by a constant j and k with a different % of ETFs available. I will conclude with work in progress to improve it further. I might add an additional post describing why the economist in me prefers Tactical Asset Allocation as an investment philosophy to the Efficient Markets Hypothesis and the Capital Asset Pricing Model.

Before I begin, I should note that the Domestic ETFs I invest in a separated into two groups, sector and style. Whichever one I can invest in earlier (sector), I will use that return and then later, I average the two's returns. I might get a better return without doing this, but that particular market is so broad that I wanted to investigate the combined effect. Not only do some sectors out perform, but sometimes value outperforms growth and large-cap outperforms small-cap. I wanted to be able to include this relationship as well, I'm just not sure how much stronger this effect is compared to the sectors. I also had a longer list of sectors that I cut down on prior to running these returns, so the ranking since I updated the data can actually choose from more sectors and gets better returns. I'm only reporting a sector basket with the 9 Spider select ETFs.

The first table represents a unlevered comparison of the AA, TAA, and Momentum TAA (with j=4 and k=2 investing in the ETFs ranking in the top 25%) with equal asset allocation between the 5 asset classes and the Risk Parity weights discussed in the previous part. The TAA beats the AA which is the conclusion reached by Faber. However, the Sharpe Ratio (@ 6% for all) increases with a more normal kurtosis (3=normal, greater than 3 indicates fat tails) by using the risk parity weights. There are similar results comparing the TAA and Momentum TAA, however it seems like the Kurosis for the TAA portfolio is relatively constant. This makes sense since the data is cut off prior to 1998 and excludes some of the larger price movements.

The next table is the same strategies and comparison as above, but with 100% leverage. It is more for general interest than comparison. The method used in the paper by Panagora was to use the Risk Parity weight and then lever the portfolio to a desired return (such as the S&P500's average return) so that variance would be minimized. In this case, the return on the TAA without Risk Parity Weights would be greater than the standard deviation on something like the S&P500. You could use roughly 20% leverage to increase the return of the TAA Risk Parity to roughly the return on the normal TAA (this same argument works to target the standard deviation as well). However, the Sharpe ratio in this case would be less than if you had not used leveraged. The return is the same, but the variance is actually greater (the same holds true for AA, TAA, and Momentum TAA). So even without the large 2-1 leverage reported below, if you measure your investment success by your Sharpe ratio, then it won't make sense to use leverage. However, relatively speaking, the risk parity weights outperform the equal weighted portfolio. If you're an investor seeking to maximize profit or would be willing to accept more risk in exchange, then you should use the risk parity instead of the equal weight portfolios.

The third table presents the CAGR, Standard Deviation, and Sharpe Ratio comparing different momentum strategies. Recall from the previous article that j represents the number of periods to look back to and k represents the number of periods to hold (since k can be greater than 1, then even if you hold 6 ETFs when k=1, it will be variable for k>1). Using more complete data, it is clear that the Sharpe Ratios increase as j comes to 3 or 4 and declines after that. However, there is no clear trend on what happens with k. It usually increases to 2 and declines after that, but it is not consistent. If at all possible, I would prefer a larger k to a smaller k since it guarantees that I will have less turnover.

Finally, the last table shows the returns with j=4 and k=2, but investing in a different percentage of the ETFs that have sufficient return histories. The trend in this case is clear, return increases as you increase the percentage until it tops out between 25 and 33.3%. However, these returns are all gross and the others could relatively increase if transactions costs are included. Furthermore, I would suspect the tax consequences are greater. Instead of picking the best sectors, at 75% you're getting out of the worst. For portfolios with less than half a million dollars, there might be too many ETFs to be able to use the 75% or 50% to make it worth it. However, I should also note that the benefit of the original TAA model is that each position can be approximated with futures contracts which could possibly reduce costs and provide an easier method to use leverage.

To conclude, gross returns and gross Sharpe ratios are greater using the Momentum TAA with risk parity portfolios. However, there are still additional ways that it could be improved. This strategy can be considered a component in a larger overall strategy. For example, Mr. Faber discusses alternative strategies such as mean reversion and following hedge fund managers that produce significant returns. I think that there are strategies in options, distressed debt, value investing, macro investing, mean reversion, and statistical arbitrage (or investing in hedge funds that specialize in stat, risk, or convertible arb) that can add to this return while not being correlated with the TAA or Momentum TAA. Unfortunately, with the exception of mean reversion, these strategies are either not quantitative (macro, distressed debt, value) or are difficult to backtest (options - competence, and arbitrage are arbitraged away).

Next, there are additional beta factors that can be considered or thought about in different ways. For example, a

recent paper indicates that the returns for currency managers are largely Beta. Those returns could be an additional asset class that could be added with little correlation to the others. Also, there is

evidence that investing in commodities based on their term structure (buy most backwardated positive roll-return commodities, short most negative roll-return contango commodities). These two strategies, combined with mean reversion of the five assets used in TAA and the Momentum TAA risk parity weights, could be particularly strong and they could be included in a broader portfolio using the risk parity weights.

Finally, I recently discussed a

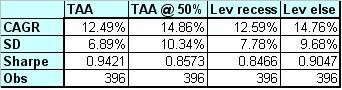

probit model I use to forecast recessions. I am considering linking that model (and augh converting it to Matlab) to this program so that I choose margin based on the probability of a recession. The returns of this strategy outperform the S&P500 during the bad times, but they still underperform compared to the remainder of the period. I'm going to consider increasing leverage when the probability estimates are low and cut off leverage when the probability begins to increase. I believe this can improve returns.

edit: There was a slight discrepancy with the interest rate data in the original results that has been corrected.

On to

Part 3.